Southwest Airlines Company (NYSE:LUV) was downgraded by stock analysts at Vetr from a "buy" rating to a "hold" rating in a report released on Monday, MarketBeat.com reports. They currently have a $41.49 price target on the airline's stock. Vetr's target price suggests a potential upside of 2.75% from the company's current price.

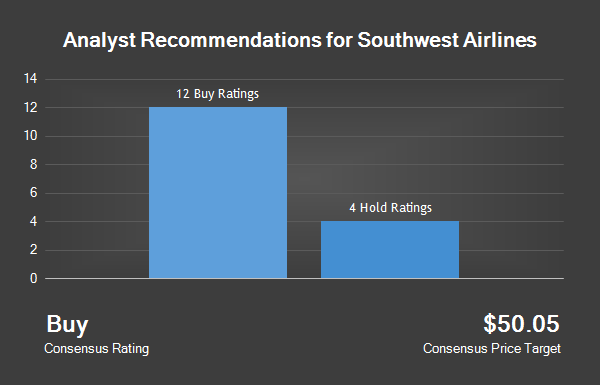

A number of other analysts also recently weighed in on LUV. Bank of America set a $50.00 price target on shares of Southwest Airlines and gave the company a "buy" rating in a report on Saturday, October 1st. Buckingham Research downgraded shares of Southwest Airlines from a "buy" rating to a "neutral" rating in a report on Friday, July 22nd. Imperial Capital began coverage on shares of Southwest Airlines in a report on Friday, September 9th. They issued an "outperform" rating and a $46.00 price target for the company.

Cowen and Company reduced their price target on shares of Southwest Airlines from $49.00 to $47.00 and set an "outperform" rating for the company in a report on Friday, July 22nd. Finally, Zacks Investment Research downgraded shares of Southwest Airlines from a "hold" rating to a "sell" rating in a report on Thursday, July 14th. One research analyst has rated the stock with a sell rating, five have given a hold rating and twelve have given a buy rating to the company's stock. Southwest Airlines currently has a consensus rating of "buy" and an average price target of $49.32.

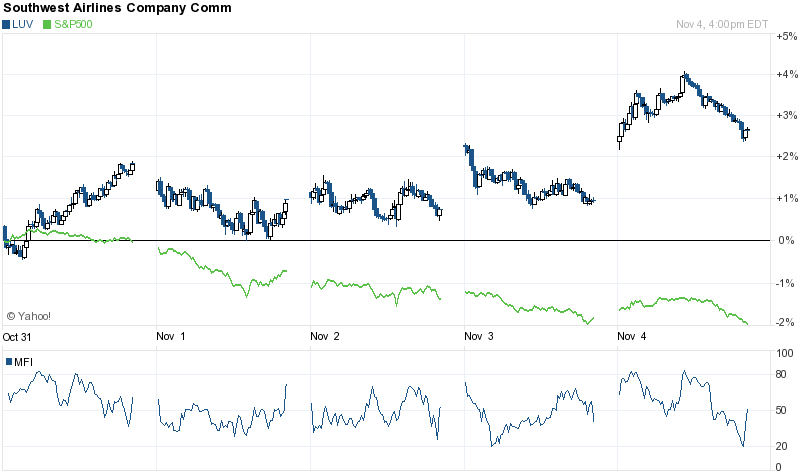

Southwest Airlines opened at 40.38 on Monday, MarketBeat.com reports. The firm's 50-day moving average is $39.43 and its 200-day moving average is $40.00. Southwest Airlines has a 1-year low of $33.96 and a 1-year high of $51.34. The firm has a market capitalization of $24.95 billion, a price-to-earnings ratio of 11.49 and a beta of 0.86.

Southwest Airlines last posted its quarterly earnings data on Wednesday, October 26th. The airline reported $0.93 earnings per share (EPS) for the quarter, topping the Thomson Reuters' consensus estimate of $0.88 by $0.05. The business earned $5.10 billion during the quarter, compared to the consensus estimate of $5.17 billion. Southwest Airlines had a net margin of 11.09% and a return on equity of 32.51%. Southwest Airlines's quarterly revenue was down 3.4% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.94 EPS. On average, equities analysts anticipate that Southwest Airlines will post $3.66 EPS for the current year.

Hedge funds and other institutional investors have recently modified their holdings of the stock. Vanguard Group Inc. raised its position in shares of Southwest Airlines by 1.9% in the second quarter. Vanguard Group Inc. now owns 38,790,694 shares of the airline's stock valued at $1,520,983,000 after buying an additional 739,007 shares during the period. BlackRock Institutional Trust Company N.A. raised its position in Southwest Airlines by 2.3% in the second quarter. BlackRock Institutional Trust Company N.A. now owns 17,921,904 shares of the airline's stock valued at $702,718,000 after buying an additional 397,249 shares during the last quarter.

JPMorgan Chase & Co raised its position in Southwest Airlines by 73.0% in the third quarter. JPMorgan Chase & Co (NYSE:JPM). now owns 9,420,861 shares of the airline's stock valued at $366,379,000 after buying an additional 3,975,382 shares during the last quarter. Bank of Montreal Can raised its position in Southwest Airlines by 4.7% in the third quarter. Bank of Montreal Can now owns 6,576,653 shares of the airline's stock valued at $255,766,000 after buying an additional 298,203 shares during the last quarter.

Finally, Janus Capital Management LLC raised its position in Southwest Airlines by 20.1% in the second quarter. Janus Capital Management LLC now owns 5,796,281 shares of the airline's stock valued at $227,272,000 after buying an additional 969,666 shares during the last quarter. 78.46% of the stock is currently owned by institutional investors.

About Southwest Airlines

Southwest Airlines Co (Southwest) operates Southwest Airlines. Southwest is a passenger airline that provides scheduled air transportation in the United States and near-international markets. The Company serves approximately 100 destinations in over 40 states, such as the District of Columbia, the Commonwealth of Puerto Rico, and approximately seven near-international countries, including Mexico, Jamaica, The Bahamas, Aruba, Dominican Republic, Costa Rica, and Belize.